by Hanna Valynets

Translated by Nick Müller

The war in Ukraine directly and indirectly affects the energy industry of other countries. For example, at the end of November 2022, after intensive bombardment, not only Ukraine but also neighboring Moldova lost electricity. Countries face much longer-term impacts across the global electricity market. There are two main trends: price increases and a transition from fossil fuels toward green energy.

How did the world’s demand for electricity change in 2022?

According to a 2023 International Energy Agency (IEA) report, the Russian invasion of Ukraine sparked a global energy crisis. In 2022, the price of energy (including for natural gas and coal) reached a record high, in turn increasing the cost of electricity production. This facilitated a sharp rise in inflation and provoked an economic downturn.

In most parts of the world, the higher electricity prices are, the lower demand falls. The IEA report notes that demand in 2022 grew only 2% in comparison to an average of 2.4% between 2015-2019.

Growth of average wholesale electricity prices was most noticeable in the European Union (EU), where it more than doubled from 2021. High prices decreased energy consumption in the EU by 3.5% in 2022. This drop in consumption is comparable to the 2008-2009 financial crisis and during the Covid-19 pandemic in 2020.

In India and in the United States (US), demand for electricity increased, but by much less than pre-pandemic, rising by 8.4% and 2.6% respectively. In China, growth was at 2.6%, significantly lower than the pre-pandemic average of over 5% (2015-2019).

Why did price hikes occur?

According to the IEA, prices for electricity grew as a consequence of higher natural gas and coal prices. Natural gas prices reached record levels and consistently exceeded the equivalent of $250 US dollars per barrel of oil. The price of coal also reached a record high, climbing to $457 per metric ton in early September 2022. In mid-year, oil prices rose significantly above $100 per barrel before falling again. This explains a 90% increase in electricity costs worldwide in 2022, and 50% of this increase caused by gas prices.

According to the Zero Carbon Group, the total of import gas expenditures multiplied in the EU, which spent €252 billion in the first three quarters of 2022, €186 billion more than the previous year. This is equivalent to a 286% increase in expenditures. To cope with rising price increases and the energy crisis, European countries spent between €500 and €768 billion to subsidize electricity and protect consumers from the short term effects of high energy prices. Bruegel writes about this in several reports.

In the regions most affected by the energy crisis, the least affected were countries with a high share of renewable energy sources; prices there for energy were lower according to Zero Carbon Analytics, citing IEA.

What will happen with prices?

According to experts from European thinktank Bruegel, in early February 2023 gas prices in Europe had fallen from their peak value, but they are still higher than they have been in the last decade. A mild winter helped the EU to soften wholesale electricity prices, but they are still high compared to recent years.

However, the problem is not only in energy prices. Delivery supply problems are expected next winter in Europe, according to IEA. Its experts explain, saying that next winter may not be as warm. In addition, imports of Russian oil ended in February while reconfiguration of Europe’s gas supplies will take time.

At the same time, experts at Germany’s Institute for Economic Research (DIW Berlin) doubt that Germany will face a shortage of gas next winter. They argue that demand for gas has fallen and that Russian gas was replaced by Norwegian supplies arriving via liquefied natural gas (LNG) terminals in Belgium and the Netherlands last winter. Germany is currently increasing the number of its own terminals.

Balance between supply and demand will remain unsteady in the EU for the next two years according to Bruegel experts. The system has a very small buffer with which to compensate for any potential supply risks. To get through the winter successfully, the EU must continue decreasing its gas consumption in order to fill its reserves to a minimum level of 90%.

EU’s departure from the Russian gas market: How did this come about?

In 2019, 41% of natural gas imports to the EU arrived from Russia, with 26.9% of total crude oil imports supplied by Russian companies, as were 46.7% of solid fuel imports according to the Climate Action Network, citing Eurostat.

Now governments are replacing Russian gas supplies, says Regina Dimitrisina, a political consultant at the Friedrich Ebert Foundation center of competence–Climate and Social Justice.

“The invasion of Ukraine changed the European energy system and seriously influenced the EU’s energy security agenda. After 24 February, diversification of gas supplies has become the main priority for most European governments. There has also been a short-term increase in electricity generation from coal,” says Dimitrisina.

On 8 March 2022, after the full-scale invasion began, the European Commission (EC) set a goal of reducing Russian gas imports by two-thirds by the end of the year.

This was planned to be accomplished through diversification of gas supplies, accelerating the transition to renewable energy, and substituting renewable sources for the gas used in heating and electricity generation

By November, the EU had replaced almost 75% of Russian gas imports, according to a report by the international research group Zero Carbon Analytics, citing the Council of Europe. At that time, Zero Carbon Analytics noted that the country supplied only 12.9% of gas to the continent. The significant phaseout of Russian supplies was largely made possible using pre-existing infrastructure for transporting gas and a sharp reduction in the demand for gas, according to analysts.

On 5 February 2023, an embargo on maritime deliveries of Russian oil products to the EU came into force, and today, deliveries by sea to third countries are possible only at low prices (the EU has set an upper limit). The United States also introduced an embargo on Russian oil in the spring of 2022.

As a result, Russia lost a significant share of its sales in the oil and gas market, including the loss of the European gas market. It was anticipated that Russia would try to redirect flows to Asia, and this has occurred. As a result, China, India, and Turkey have benefited from market redistribution after the ban on Russian gas, coal and oil products, writes the Insider. Turkey is also attempting to replace Russia in the European gas market, partially by buying Russian oil and gas (as well as fossil fuels from the Middle East, Azerbaijan, and Kazakhstan), by increasing transit routes and working to create a gas hub for subsequent export to Europe.

Changes in global demand for fossil fuels

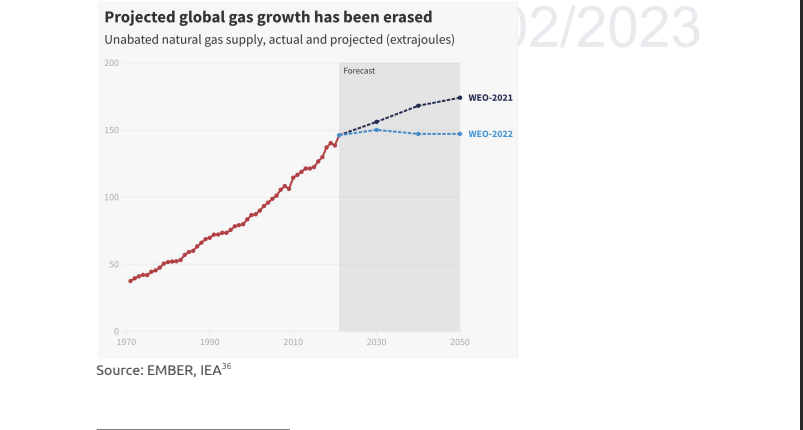

The IEA predicted in 2022 global fossil fuel demand could soon plateau and stop growing in the long term.

At the same time, global production of coal and gas will generally stay at the same level, as growth in demand in the Middle East and Asia-Pacific regions will be offset by declines in Europe and America, writes Zero Carbon Analytics, citing the IEA.

EU demand for gas in the first nine months of 2022 decreased by over 10% as compared to the same period in 2021. EU gas demand is expected to fall by 43% by 2030 if the EU meets its long-term climate change commitments, and by no less than 19% even without further policy changes.

In the global market, demand for gas is projected to peak by the end of the decade, going only on the basis of current countries’ policies. If countries meet their long-term climate goals, demand for gas will fall by 10%.

It is also expected that growth in demand for natural gas in developing economies in Asia in 2021-2025 will be 50% lower compared to the previous year’s forecast, and that sustained high prices “may further undermine demand growth prospects for gas and LNG in developing Asian countries,” the IEA reports.

How the EU and EECCA countries are shedding their dependence on Russian energy

To reduce dependence on fossil fuels and increase resilience to price shocks, in May 2022 the European Commission developed and published the REPowerEU plan to accelerate the adoption of clean energy.

In December, the Council of Europe and the European Parliament reached a preliminary agreement on REPowerEU. This means that EU member states will receive grants and loans for the implementation of new measures that they must incorporate into their national recovery and resiliency plans.

According to the European Commission, an additional €210 billion of public and private sector investments are needed to phase out supply of fossil fuels from Russia by 2027. The phaseout will be funded by the Recovery and Resilience Fund (RRF).

The EU plan’s challenges include insufficient political support, additional required documentation (bureaucratic red tape) for the construction of renewable energy infrastructure (REI), and managing network overload when connecting REI. Additionally, implementation of REPowerEU leads to a weakening of environmental legislation. Specifically, it will result in rejection of some procedures for assessing the impact of renewable energy on the environment.

Achieving energy independence from Russia is a difficult task not only for Europe, but also for EECCA countries (Eastern Europe, Caucasus, Central Asia), writes Climate Action Network. There are several strategies for recovering from this dependence.

The first strategy is diversification of energy sources and expanded use of decentralized renewable energy sources such as solar, wind, and geothermal, along with investments in energy storage technologies.

The second is to improve energy efficiency. Some countries in the EECCA region lose an average of 70% of heat produced in winter months, according to a joint study published by the Institute for New Energy Systems in Germany and the Institute for Energy and Sustainable Development in the United Kingdom.

60-80% of buildings in Central Asia are earthen structures built mostly from soil, clay, or adobe without proper building codes. The age of dwellings, combined with vernacular architecture, is a key reason for high energy use for heating Central Asia’s residential sector. “The lack of modern heat supply services, low income levels of the population, and high heat demand in energy-inefficient residential buildings in rural areas contribute to the use of solid fuels for home heating,” the researchers write.

How is green energy developing?

Russia’s invasion of Ukraine has created serious challenges for the transition to a green economy in EECCA countries, writes Climate Action Network. The war has forced countries to prioritize energy security issues ahead of climate issues.

Despite this, in Ukraine, decentralized renewable energy sources are sometimes the solution to both problems simultaneously. For example, in Kyrgyzstan Climate Action Network EECCA member Unison Group is working on legislation for a green transition with the government’s support.

The drop in Russian gas purchases from the EU “does not mean greater climate neutrality in the short term. The reason is the short-term use of coal and increased LNG imports. Such gas imports began to be used as an alternative import option in connection with the Russian invasion of Ukraine,” says Regina Dimitrisina from Ebert Foundation.

However, wind and solar generated a record 22% of electricity supplies in the EU in 2022, surpassing fossil gas (20%) for the first time, leaving coal far behind (16%) as well, writes Zero Carbon Analytics, citing the think tank Ember. Coal production in the EU decreased by 6% in the last four months of 2022 compared to the same period in 2021.

According to Ember’s analysis, fossil fuel production in Europe may drop by 20% in 2023.

Heat pump adoption in Europe increased dramatically in 2022, with sales up 120% in Poland, 100% in Slovakia and Belgium, and 50% or more in Finland, Czech Republic, and Germany, writes Zero Carbon Analytics. There is also an interesting recent trend to increase the production of renewable energy: Europe is considering possible sites in Africa.

Over the long term, one important direction for overcoming the energy crisis and dependence on Russian energy carriers is to accelerate the development of renewable energy sources.

EU wind and solar production rose by 13% in the months following Russia’s invasion of Ukraine, think tank Ember said in October 2022. This record growth in renewable generation has saved the equivalent of €11 billion that would have otherwise been spent on gas imports.

Solar generation also replaced $34 billion in fossil fuel expenditures alone in the first six months of 2022 in seven Asian countries – China, India, Japan, South Korea, the Philippines, and Thailand, writes Zero Carbon Analytics, citing the IEA. This is equivalent to 9% of total fossil fuel expenditures in these countries over the same period.In the future, it is predicted that 88% of the increase in electricity production before 2025 will come from renewable energy sources, with a mere 1% from fossil fuels. In the next five years, it is also planned to add as much renewable energy around the world as in the last 20, writes Zero Carbon Analytics, citing the IEA.

Nuclear energy misses a second wind

How did nuclear energy fare in the context of the war? The Ukrainian post-war reconstruction plan mentions the construction of nine new power units (the same number operated in Ukrainian-controlled territory in December).

But while Ukraine plans post-war actions, Rosatom is already signing agreements and working with governments in Central Asian countries to resolve issues related to construction of nuclear power plants. Construction was announced in Uzbekistan, as were cooperation agreements with Kazakhstan and Kyrgyzstan. None of these countries currently have nuclear power plants, Climate Action Network explains.

“When Rosatom builds new nuclear reactors in a developing country, it cements a century or more of dependence on Russia,” explains Vladimir Slivyak, co-chair of the Russian environmental group Ecodefense.

In stark contrast, nuclear power collapsed in the EU despite a degree of support for it in energy security terms, for example, extending the life of already operational nuclear power plants. One of those countries is Germany, it was decided to extend the life of two of the three remaining nuclear reactors through the first half of 2023. Belgium is another example where the service life of two reactors was extended by another decade.

Between 2006-2020, nuclear power generation in the EU, writes the European Commission, decreased by 25%. According to Eurostat data, by 2020 the EU produced 24% of all electricity from nuclear power plants located in 13 countries.

However, both the European Commission and the United Nations Intergovernmental Panel on Climate Change (IPCC) continue to believe that nuclear power will help countries meet their climate commitments. Environmental organizations counter that the problem of storing nuclear waste has not been resolved.

With the start of the war, opponents of nuclear power gained a new argument. Nuclear power facilities are at high risk of emergency situations during active hostilities and can become objects for blackmail or, conversely, strengthen the geopolitical power of individual parties.

Long-term trends

In 2022, the war and related events significantly affected the electricity market in the EU and around the world. In particular, demand for electricity grew more slowly, and, in some places even dropped. The reason was the ultra-high energy prices caused by the impact of war and sanctions, as well as the shortage of energy carriers and the desire to abandon fossil fuels. Redistribution of fossil fuel supplies may result in more uncertainty over the next two years for the balance of energy supply and demand in the EU. The EU seeks to stabilize matters by reducing gas consumption and topping off its storage facilities.

This war is changing fossil fuel demand around the world. In the near term, the IEA has forecasted, for the first time ever, that demand may stop growing and plateau. The nuclear power sector has seen some gains, but in general its market in the EU has collapsed. Together, these trends combine in parallel with green energy’s strengthened position.

Main image source: WorldWide

Comment on “How did Russia’s invasion of Ukraine change the electricity market in Europe?”